how much federal tax is deducted from a paycheck in ma

Contacting the Department of Unemployment Assistance to fulfill obligations for state employment security taxes. Get ready today to.

Self Employment Tax Everything You Need To Know Smartasset

If a resident of Georgia is earning more than 200000 then an additional tax is also applied on the paycheck called Medicare surtax.

. FICA taxes consist of Social Security and Medicare taxes. You are able to use our Massachusetts State Tax Calculator to calculate your total tax costs in the tax year 202223. Payroll taxes in Massachusetts Massachusetts income tax withholding It doesnt matter how much you make.

ST Delaware State Income Tax. That goes for both earned income wages salary commissions and unearned income interest and dividends. The income tax rate in Massachusetts is 500.

From your paycheck the total tax constituting FICA is 29 Medicare and 124 Social security of your wages. As of January 1 2020 everyone pays 5 on personal income. Form M-4 Massachusetts Employees Withholding Exemption Certificate is optional.

Also What is the percentage of federal taxes taken out of a paycheck 2021. Overview of Massachusetts Taxes. A single filer will take home 5762050 on a 78000 annual wage.

A married couple will take home 11615840 on a combined annual salary of 156000. FT Federal Income Tax. Social security tax and medicare tax are two federal taxes deducted from your paycheck.

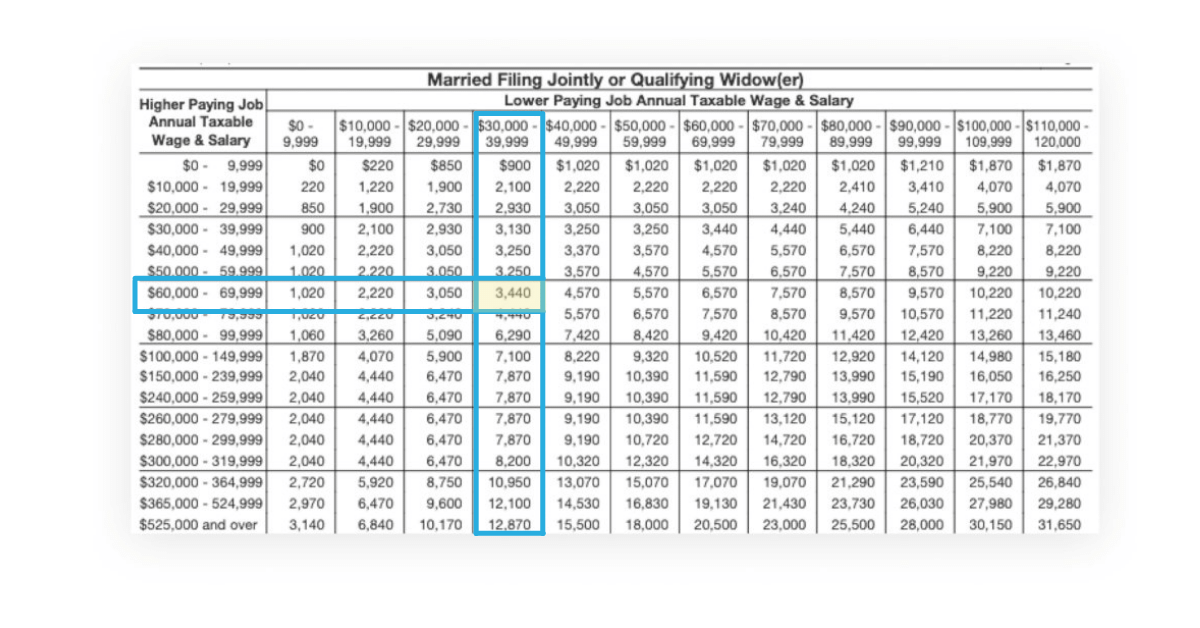

The table below details how Federal Income Tax is calculated in 2022. Using the Delaware Income Tax Formula we can now illustrate how to calculate 8000000 after tax in Delaware. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions. Typically employees and their employers split that bill which is why employees have 62 and 145 respectively held from their paychecks. The Medicare tax rate is 145.

DT FT-FD ST-SD Where. IR-2019-178 Get Ready for Taxes. Our calculator has been specially developed in order to provide the users of the calculator with not.

From your paycheck the total tax constituting FICA is 29 Medicare and 124 Social security of your wages. Use tab to go to the next focusable element. Your employer pays another 62 percent on your behalf.

However they dont include all taxes related to payroll. Individual Income Tax Returns. The social security tax is 62 percent of your total pay until you reach an annual income threshold.

Massachusetts is a flat tax state that charges a tax rate of 500. Federal income tax rates range from 10 up to a top marginal rate of 37. For Medicare you both pay 14 percent no matter how much you make.

SD Delaware State Income Tax Deductions. FICA taxes are commonly called the payroll tax. The amount of federal and Massachusetts income tax withheld for the prior year.

FD Federal Income Tax Deductions. For 2020 if you itemize on US. Schedule A line 4.

What taxes do Massachusettsan pay. Federal Paycheck Quick Facts. If you earn more than 200000 in a year your employer must withhold an additional 09 percent for the additional Medicare tax.

What is the massachusetts tax law. You must itemize deductions on your Form 1040 - US. Median household income in 2020 was 67340.

These amounts are paid by both employees and employers. The state-level payroll tax is 075 of taxable wage up to 137700 and the income tax is a flat rate of 5. Take home pay for 2022 Its important to revisit your tax withholding especially if major changes from the tax cuts and jobs act affected the size of your.

For 2022 employees will pay 62 in Social Security on the first 147000 of wages. Your new employees should fill out Federal Form W-4 Employees Withholding Certificate. Jan 12 2021 the tax rate is 6 of the first 7000 of taxable income an employee earns annually.

The Federal Income Tax calculation includes Standard deductions and Personal Income Tax Rates and Thresholds as detailed in the Federal Tax Tables published by the IRS in 2022. Thats because the IRS imposes a 124 Social Security tax and a 29 Medicare tax on net earnings. Schedule A Line 4 and have medicaldental expenses greater than 75 of federal AGI you may claim a medical and dental exemption in Massachusetts equal to the amount you reported on US.

22 for 40525 - 86375 24 for 86436 - 164925 and so on. Doing Taxes For Doordash. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck.

How much do you make after taxes in Massachusetts. For unemployment insurance information call 617 626-5075. Federal Tax Calculation for 170k Salary.

The IRS encourages everyone including those who typically receive large refunds to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their pay. As of 2015 FICA taxes for Social Security take 62 percent of your salary up to 118500. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you.

Jan 01 2020 when massachusetts income tax withheld is 500 or more by the 7th 15th 22nd and last day of a month pay over within 3 business days after that. DT Delaware Income Tax. States dont impose their own income tax for tax year 2022.

In this 09 more tax is deducted for Medicare purposes.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Payroll And Tax Deductions Infographic Paycor Hr And Payroll Payroll Taxes Payroll Tax Deductions

2022 Federal State Payroll Tax Rates For Employers

6 Common Types Of Payroll Withholdings Deductions

Learn More About The Massachusetts State Tax Rate H R Block

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

How To Deduct Your Home Office On Your Taxes Forbes Advisor

Payroll And Tax Deductions Infographic Paycor Hr And Payroll Payroll Taxes Payroll Tax Deductions

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

How To Calculate Income Tax Quora

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

A Cheat Sheet For Small Business Tax Deductions Simple Startup

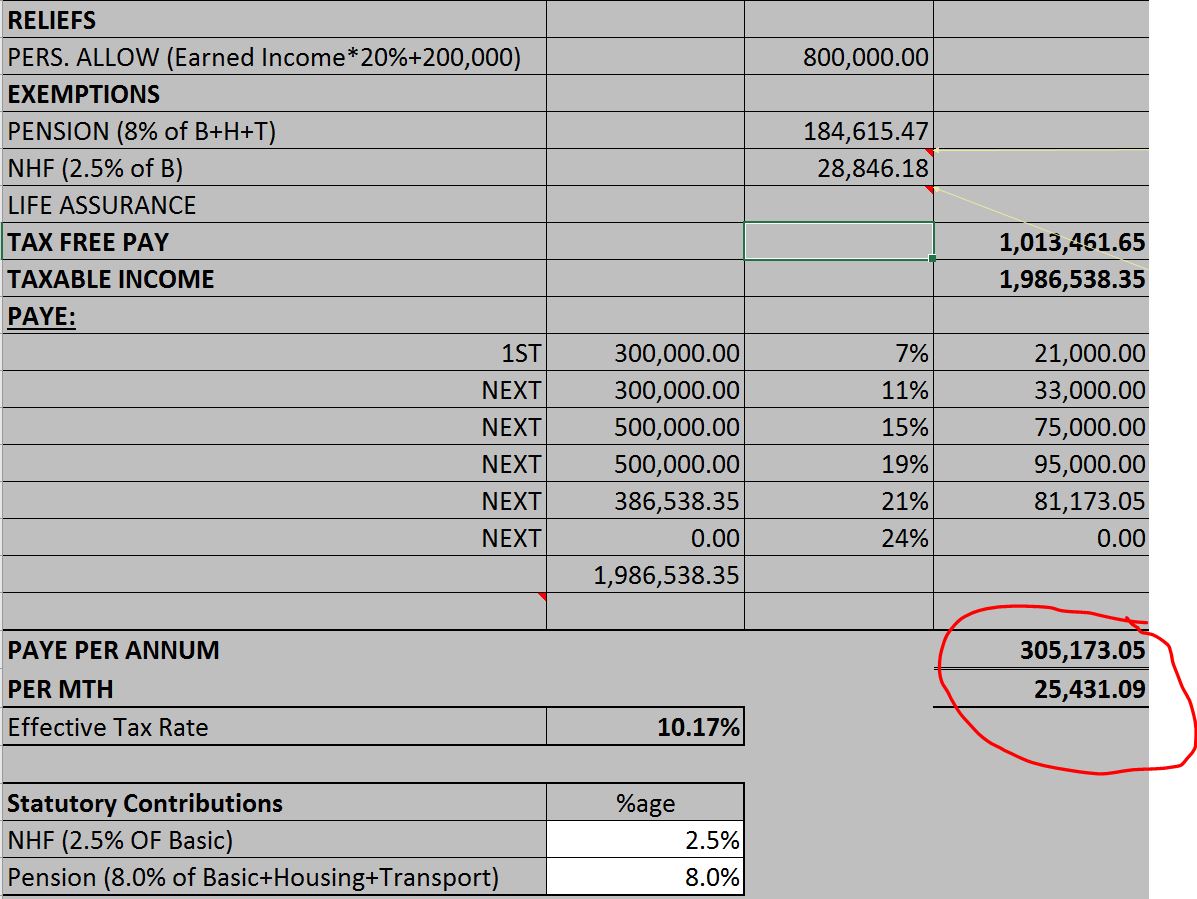

How To Calculate Your Taxes Using Paye Nairametrics

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll